Industry leading credit risk models

Valuatum SaaS credit risk analysis software revolutionizes credit rating process through advanced automation and dynamic credit risk models. Valuatum offers the most accurate credit ratings including automated analysis and reporting. Valuatum’s platform creates value through the credit value chain from credit applicant to investors. You can access our credit risk presentation here.

SPEED UP CREDIT APPLICATION PROCESS

Receive pre-rated credit applications and reports for further analysis

Improve the average quality of credit applications

Generate different types of automatic reports

STATE-OF-THE ART BANKRUPTCY MODELS

Based on advanced machine-learning algorithms

Models adapt to situations where traditional models fail

No more missed opportunities or decisions based on misleading information

VERSATILE CREDIT ANALYSIS PLATFORM

Access and edit your data anywhere via web browser, Excel models, or APIs

Platform can be tailored to fit your needs exactly

Access to audited financial data of nearly 200 000 Finnish companies

Valuatum’s platform creates value to all participants of the credit supply chain

![]() Easily sent your credit application to multiple lenders through Valuatum’s platform

Easily sent your credit application to multiple lenders through Valuatum’s platform![]() User-friendly interface provides fast and logical data entry for application

User-friendly interface provides fast and logical data entry for application![]() Transparent credit application process and feedback report with suggestion in case of rejected application

Transparent credit application process and feedback report with suggestion in case of rejected application

Automated credit application process and reports save time and effort

Automated credit application process and reports save time and effort Increase the chance of making profitable credit decisions and reduce risks

Increase the chance of making profitable credit decisions and reduce risks Multiple customization options, access to extensive database and versatile comparison tools

Multiple customization options, access to extensive database and versatile comparison tools

Receive standardized credit reports on case companies

Receive standardized credit reports on case companies Increase transparency between investor and broker

Increase transparency between investor and broker Loans granted by using Valuatum’s software are more accurately rated

Loans granted by using Valuatum’s software are more accurately rated

Compare how Valuatum’s model outperforms the prevailing way to do credit risk analysis

PREVAILING WAY

PROCESS

APPROACH

- Use of inaccurate and outdated models and methods where bankruptcy risk is often estimated just by looking at a few financial ratios

- Does not take into account the individual characteristics of case companies

RESULT

- Prevailing way places all companies into same mold, failing to estimate bankruptcy risk accurately in cases where individual approach is needed

VALUATUM WAY

PROCESS

- Most of the time consuming tasks are automated

APPROACH

- Based on advanced models and methods where bankruptcy risk is estimated by dynamically weighting financial ratios

- Takes into account the unique nature of each case company

RESULT

- Valuatum’s way chooses the most suitable financial ratios and adjusts weights to fit each scenario

- Bankruptcy risk is estimated accurately for each individual case, leading to efficient and accurate credit risk analysis

Real-life examples of how traditional credit rating estimation methods might fail

Examples below will provide some insight on cases that highlight the superiority of modern machine-learning algorithms over more traditional models that use fixed weights. In all cases fixed-weight models might easily lead into costly mistakes, while dynamically weighting the most important variables in each case will help to concentrate on what really matters.

EXAMPLE 1

COMPANY PROFILE

- Company A’s business is relatively stable. It has a high profitability with a good financial standing. Thus they don’t need to maintain good liquidity because they can easily get credit from the banks if needed.

CREDIT RISK ESTIMATION

- Due to fixed weights, prevailing model(s) overemphasize the impact of liquidity. This makes Company A’s estimated bankruptcy risk to be higher than it really is, which also makes its credit rating worse.

- Machine-learning models will correctly put less emphasis on liquidity and concentrate on other figures instead.

RESULT

- Traditional models might cause the lender to miss a good low-risk investment opportunity due to too high weighting on liquidity where it does not matter much. Moreover, Company A’s interest rate is higher than it should be.

- Machine-learning models recognize that liquidity is less important with companies like Company A and therefore assign a correct credit rating and allow lender to capitalize on a low-risk opportunity. Company A is offered the interest rate it deserves.

EXAMPLE 2

COMPANY PROFILE

- Company B has poor profitability and it is making heavy losses. It has a weak financial standing with high indebtedness. Thus it doesn’t have buffers to face any setbacks.

CREDIT RISK ESTIMATION

- With these type of cases all comes down to liquidity and models with fixed weights often under-estimate its impact. This makes Company B seem more creditworthy than it really is.

- Machine-learning models will understand that the importance of liquidity increases in cases like Company B and correctly put more emphasis on it and less emphasis on other figures.

RESULT

- Using traditional models, lender might make too risky of an investment based on inaccurate credit rating caused by poor liquidity.

- Using machine-learning models, lender would be able to correctly evaluate the riskiness of the investment and assign an appropriate credit rating and interest rate.

EXAMPLE 3

COMPANY PROFILE

- Company C is highly profitable and has relatively low indebtedness, making C look like a solid low-risk company. However, upon closer inspection it is noticed that the company has high sales receivables turnover time and balance sheet consists of almost exclusively sales receivables

CREDIT RISK ESTIMATION

- Models with fixed weights assign a good credit rating due to high profitability and low indebtedness, paying little attention to potential underlying problems.

- Machine-learning models are able to recognize that despite seemingly good financial standing, the high receivables turnover time might indicate that the company is actually in a bad situation financially.

RESULT

- Using traditional models, lender might make too risky of an investment based on inaccurate credit rating.

- Machine-learning models are able to flag the company and the lender knows to look into the details and check the actual financial state of the company, potentially allowing them to dodge a high-risk investment.

Key features of Valuatum Credit Risk Platform

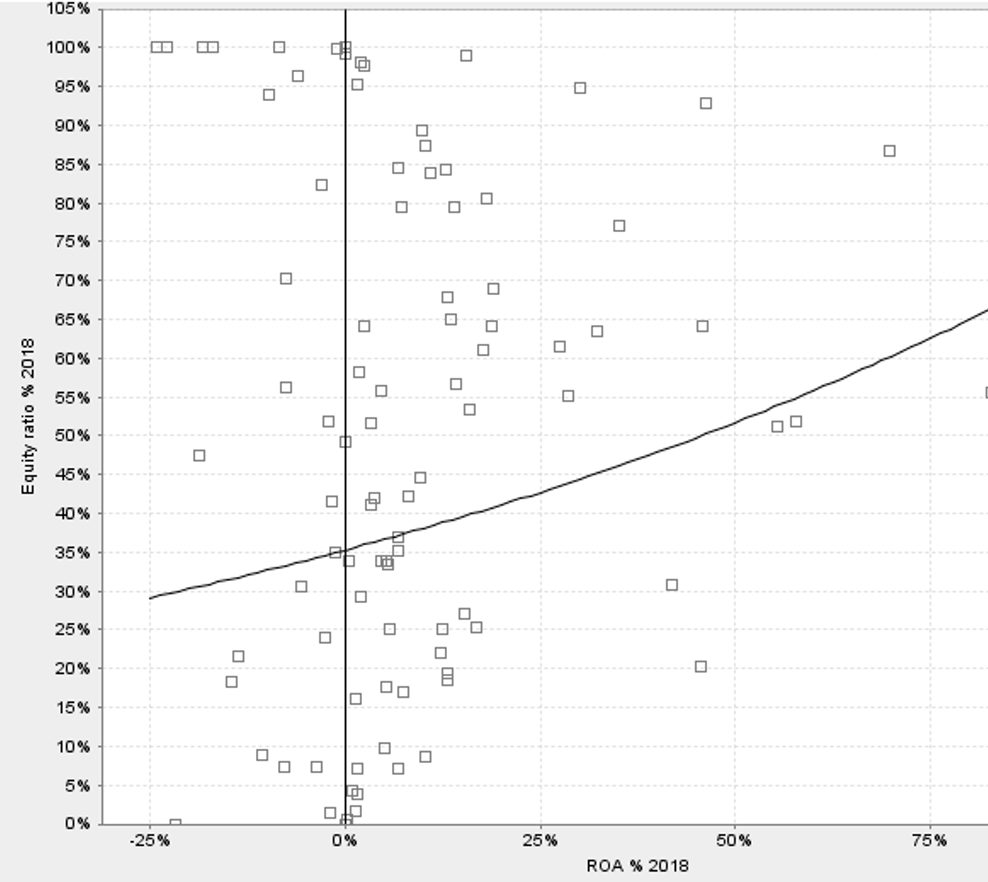

Comparison tools

Peer group analysis

Peer group analysis Versatile selections

Versatile selections Hundreds of variables

Hundreds of variables Lists and scatter plots

Lists and scatter plots

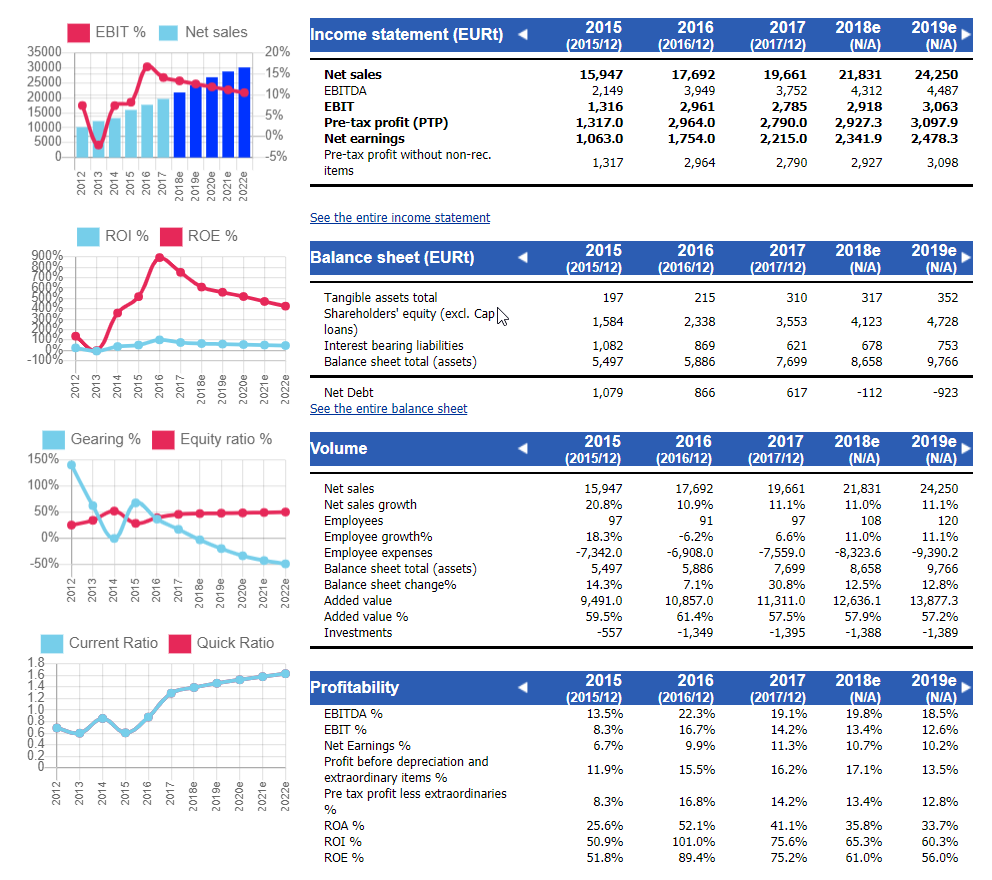

Automatic reports

Pre-filled tables and graphs

Pre-filled tables and graphs Customizable layouts

Customizable layouts PDF and Word formats

PDF and Word formats One-click printing

One-click printing

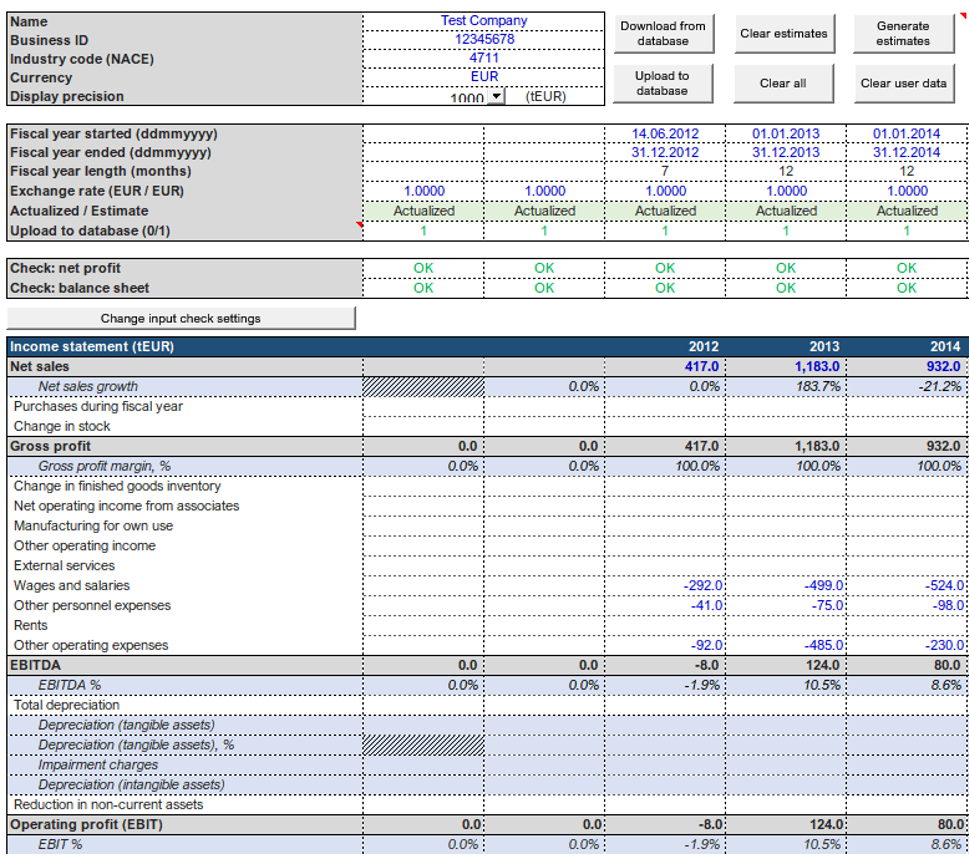

Excel models

Edit financial data effortlessly

Edit financial data effortlessly User friendly interface

User friendly interface Automatic features

Automatic features Support for custom sheets

Support for custom sheets